If statistics by Sammy Omukoko (the managing director of Metropol Corporation) is anything to go by, over 6 million Kenyans were negatively listed on CRB by September 2022.

This translates to 22% of Kenya’s population failing to service their loans.

Where do you stand? Are you among the defaulters?

Probably you don’t even know whether or not you are listed in CRB…

Anyway, how can you check whether you are listed in CRB, and by which financial institution?

Read on to find out more.

When Do You Appear in CRB Negative Listing?

Once you stop repaying your loan as agreed in the lender’s terms and conditions, you automatically become a defaulter.

However, your financial institution will not list you immediately.

For instance, if you default on a loan from Banks like KCB, Equity, Cooperative, and Absa for 90 days, the bank will notify you that they will list you in CRB if you don’t repay their loan.

For mobile lenders like Fuliza and Tala, it’s usually 30 days.

Learn more here: How Long Does It Take To Be Listed In CRB?

How to Check Who Listed You in CRB

It’s essential to know whether your name appears on the CRB negative listing and which financial institution listed you.

This is if you care about having a positive credit score. But how do you do this?

First, you must register your name with any of the three registered Credit Reference Bureaus in Kenya.

Their duty is to research the financial status of Kenyans, manage, and share that information. They include:

A. How to Check on CreditInfo

CreditInfo CRB has the easiest way of checking your CRB status and who listed you.

First, you visit their website at https: ke.creditinfo.com/.

Then, tap on the Credit Report and complete the personal application form.

If you’re checking CRB for your organization, choose and fill out the company application form.

Click on submit option to get your status report.

You will receive this report in your email, and it shows detailed information about all lenders that have listed you.

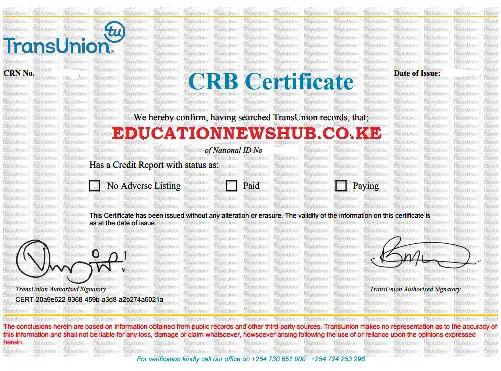

B. How to Check on TransUnion

To check your CRB status on TransUnion, you must first send your names to 21272 to register.

This SMS will only cost you Ksh.19. You’ll then pay Ksh.50 to their pay bill, 212121.

You can also download and install the TransUnion app on your mobile phone from the play store and register there.

This saves you the stress of sending SMSs. Pay Ksh.50 to the same pay bill to continue with your registration.

Next, put your identification number and select Credit Status.

You’ll then receive your CRB report showing whether you have a positive credit score or blacklisted and by which financial institution.

If your name does not appear on the CRB negative listing, you can request your CRB clearance certificate by paying Ksh.2200 processing fee.

You’ll get the certificate within three working days.

C. How to Check on Metropol Corporation

Metropol is the easiest, most popular, and preferred way Kenyans check their CRB status.

There are three ways to check your status through this corporation.

- By dialing *433# on your mobile phone

- By downloading their app from the play store (Metropol Crystobol app)

- By visiting Metropol’s official website

Checking your status by dialing *433# is the most simplified option for this CRB.

Once you dial the USSD code, you must pay Ksh.50 to Metropol’s pay bill number, 220388. For the account number option, use your ID.

Once they process the transactions, they’ll send you an SMS message containing such details as; reference number, pin details, and a link.

You’ll then click that link, enter that pin and reference number, and then receive your CRB report.

If you prefer to use the app, it’s straightforward as you easily follow their on-screen steps until you receive your CRB status.

If you don’t want to install the Metropol App, you can visit their official website, https://www.metropol.co.ke/.

You tap the registration icon here, enter your details as requested on each field, and follow their on-screen guides.

Once you submit all the details as requested, you’ll receive your CRB status report showing your credit score and which lenders have listed you on CRB.

How to Get Yourself Out of CRB Listing

Now that you know the financial institutions that listed you on CRB, you can clear your name by paying all your defaulted loan (s).

If you still can’t repay the whole amount, approach your lender and negotiate a manageable repayment plan.

Most financial institutions delist you from CRB once you keep your word and repay the outstanding loan as agreed.

If you manage to clear your loan, how long will it take to be cleared from CRB? Check out this post for a comprehensive answer: How Long Does It Take to Be Cleared from CRB?

We also have a couple of CRB-related posts that can help you further decode CRB listing issues. Check them out via links below:

Was CRB Listing in Kenya Suspended?