Do you know your credit score can affect your loan application and business?

Sometimes, employers and companies consider your credit score when you apply for a tender or an employment position.

If your name is on CRB, your credit score drops significantly. For this reason, it’s essential to avoid getting blacklisted by all means and try to obtain a credit reference bureau certificate.

But the big question is: how long does it take to be cleared from CRB?

Let’s investigate…

Why You Can Get Blacklisted by CRB

Once you default on your loan from a financial institution, your name automatically gets listed on CRB.

Also, most lenders list you on CRB if the person you guaranteed failed to pay their loan on time.

You must repay the loan and get cleared from CRB to increase your credit score.

Related: How to Check Who Listed You in CRB

How long it takes to get a CRB Certificate

Once you clear your debt, it takes three days for the financial institution to process your payments and send the repayment status to CRB.

The CRB will work on your case and produce your clearance certificate within three days.

For instance, if institutions like Equity Bank, Okash, KCB, Co-operative Bank, and Shika list you, the CRB will clear your name and issue your certificate within three days.

This is after they receive your repayment status from your lender.

You can then check your CRB status by dialing *433# followed by your pin to confirm if your name is cleared.

However, your name will remain on the negative listing. Once you clear your debt, it takes five years to get delisted from the default listing.

Yes, you read that right! Your credit history (including past defaults) will still be on CRB even after you’ve cleared the loan.

This means that lending institutions will still be able to see your past loan repayment data.

And this information remain on CRB for up to 5 years before it is completely removed.

Related: HOW LONG DOES IT TAKE TO BE LISTED IN CRB?

How to Clear Your Name from CRB

It’s easy to get cleared from CRB if you know the lender that listed you.

Here, you contact the institution and pay your debt. You can negotiate a manageable payment plan with them if you don’t have the total amount.

Most lenders agree to delist you from CRB if you honor your word and repay a significant amount of what you owe them.

Once the financial institution is satisfied with your repayment, they write a letter to the CRB to request them to clear your name from their negative listing.

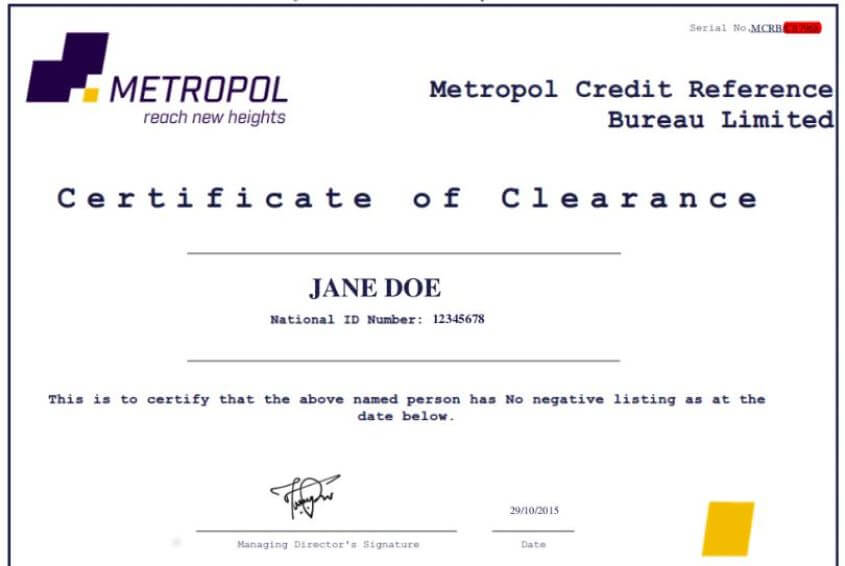

After this, you must obtain a CRB clearance certificate by applying through any CRB company licensed by the Central Bank of Kenya. They include;

This certificate will cost you Ksh.2,200, and you’ll receive it within three days.

PRO TIP: Clearing doesn’t mean that your name is completely removed from CRB. It is your status that changes from negative listing to positive listing—which simply implies that you don’t have outstanding loan. Learn more about CRB positive listing here: WHAT DOES POSITIVE LISTING MEAN IN CRB?

Parting Thoughts

Your credit score improves once you get cleared from CRB.

Therefore, you need to make the right financial decisions regarding loans and payment plans to avoid getting listed on CRB.

You may also want to check:

CAN TALA LIST YOU ON CRB?

WAS CRB LISTING IN KENYA SUSPENDED? HERE’S WHAT YOU NEED TO KNOW